How can DTC brands scale efficiently? By partnering with 3PL providers that match your needs and building regional fulfillment networks. This approach helps brands reduce shipping costs, speed up delivery times, and meet customer expectations.

Key takeaways:

- Regional Fulfillment: Distributing inventory across multiple centers lowers shipping costs by 15–25% and shortens delivery times to 2–3 days.

- Shipping Zones Matter: Shipping locally (Zone 2) costs $5.50, while cross-country (Zone 8) jumps to $12.50.

- Cost Savings: Brands using 3PLs save up to 40% on shipping via carrier discounts and optimized zones.

- Scalability: Multi-node fulfillment is ideal for brands earning $8M+ annually, while single-node works for smaller operations.

- Technology: Real-time inventory tracking, order routing, and SLA monitoring are critical for success.

Investing in a 3PL partner and leveraging data-driven tools can transform logistics into a scalable, efficient process.

Where Should My Fulfillment Distribution Be?

How Regional Distribution Networks Work

3PL Fulfillment Strategy Comparison: Single-Node vs Multi-Node Networks for DTC Brands

Efficient regional fulfillment plays a crucial role in helping DTC brands scale effectively. By strategically placing inventory closer to customers, brands can leverage optimal distribution corridors and expand their fulfillment networks.

Major U.S. Fulfillment Corridors

The U.S. is divided into four main distribution corridors, each with unique advantages:

- Northeast Corridor: This area includes hubs like Rhode Island, New Jersey, and Pennsylvania, which enable 1–3 day ground delivery to 70% of the U.S. population.

- West Coast Corridor: Anchored by cities like Los Angeles, Long Beach, and Seattle, this corridor is vital for brands importing goods from Asia via ocean freight. However, shipping from California to the East Coast often incurs costly Zone 8 rates, impacting the 210 million Americans who might otherwise benefit from cheaper shipping.

- Central/Midwest Corridor: With key hubs in Columbus, Ohio, and Chicago, this corridor offers strategic advantages for middle-mile logistics. Columbus alone supports 1–3 day ground shipping to 70% of the U.S. population.

- Southern/Texas Corridor: Locations such as Dallas and Savannah boast strong infrastructure and a growing workforce. Savannah, in particular, is making waves as the fastest-growing port on the East Coast.

Choosing the right corridor is essential for shaping your fulfillment zone strategy.

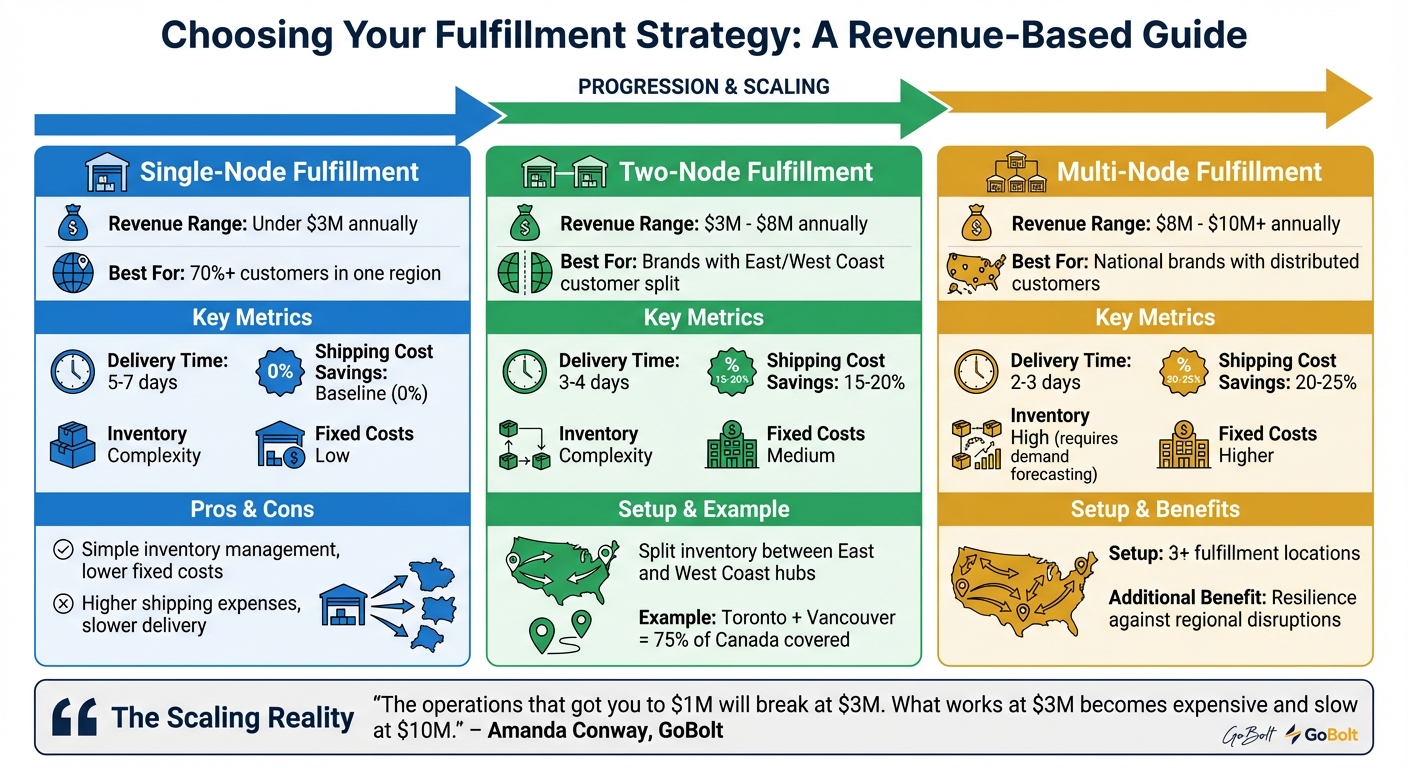

Single-Zone vs. Multi-Zone Fulfillment

Your fulfillment approach should align with your revenue stage and where your customers are located:

- Single-zone fulfillment: Ideal for brands with annual revenues under $3 million or those with 70% or more of their customers concentrated in one region. This setup keeps inventory management simple and fixed costs low but may lead to higher shipping expenses and slower delivery times of 5–7 days.

- Two-node fulfillment: Best suited for brands generating $3 million to $8 million in revenue. Splitting inventory between East and West Coast hubs can cut shipping costs by 15–20% and reduce delivery times to 3–4 days.

- Multi-node fulfillment: For brands earning $8 million to $10 million or more, this strategy involves operating from three or more locations. While it requires more precise demand forecasting and higher inventory levels, it can lower shipping costs by 20–25% and speed up deliveries to 2–3 days.

"The operations that got you to $1M will break at $3M. What works at $3M becomes expensive and slow at $10M."

– Amanda Conway, GoBolt

A real-world example from 2025 shows how Canadian DTC brands using GoBolt's Toronto and Vancouver facilities improved delivery times from 5–7 days to just 2–4 days. The Toronto/GTA warehouse alone served 50% of Canada’s population, and a two-node strategy expanded coverage to over 75%.

Expanding from Regional to National Coverage

Once a regional fulfillment strategy is established, transitioning to a national model can further enhance both shipping efficiency and delivery speed.

A common approach is to start with an East Coast hub, as it provides access to the largest market at the lowest average shipping cost. As order volumes grow - typically exceeding 3,000 per month per location - brands can add a second fulfillment center. When revenues surpass $8 million, expanding to three or more nodes becomes logical.

Many brands rely on 3PL networks to achieve national coverage without heavy upfront investment in new facilities. Using a 3PL compatibility checker can help identify partners that align with these specific regional requirements. This distributed model not only expands reach but also builds resilience. However, managing multiple nodes can lead to common 3PL conflicts regarding inventory visibility and SLA consistency. For instance, if one location faces delays due to weather or labor shortages, other nodes can step in to handle the volume.

One example of this approach comes from an Etail Solutions customer who implemented a distributed inventory strategy. By placing inventory closer to customers, they saved $5.7 million in shipping costs and reduced their carbon footprint by 35%. The success of this strategy hinged on using Distributed Order Management (DOM) technology to route orders based on real-time inventory, customer location, and shipping costs.

How 3PLs Reduce Fulfillment Costs

Fulfillment costs, especially shipping expenses (which account for 15%–25% of an order's value or 8%–12% of total revenue), can significantly impact the profitability of direct-to-consumer (DTC) brands. Partnering with a third-party logistics provider (3PL) helps lower these costs through volume discounts, better shipping zone strategies, and improved operational efficiency.

Cost-Per-Order Benchmarks

Having clear cost benchmarks is essential for managing fulfillment expenses. In 2025, the average B2C fulfillment cost is around $3.25+ per order, with fulfillment fees typically eating up 25% to 35% of each order’s value. For DTC brands, blended shipping costs range between $7 and $12 per package.

A common mistake brands make when evaluating 3PLs is focusing on individual cost components like storage rates or shipping discounts instead of calculating the full cost of fulfillment. As Tony Runyan, Chief Client Officer at Red Stag Fulfillment, puts it:

"The only way you can really get to an apples-to-apples 3PL price comparison is to calculate the total cost of fulfillment."

When assessing 3PL pricing, consider every cost: account setup fees ($250–$1,000+), monthly storage fees ($15–$40 per pallet or ~$0.46 per cubic foot), pick-and-pack charges ($0.20–$2.00+), inbound receiving fees ($5–$15 per pallet), and extra charges like residential delivery fees ($4.00–$5.35) and fuel surcharges (10%–15%). Brands with high SKU counts can often cut monthly storage costs by about 40% when switching from pallet-based to cubic-foot pricing.

3PLs also secure shipping discounts by consolidating the shipping volume of multiple brands. These discounts range from 10% to 30% off standard carrier rates, which are often inaccessible to individual DTC brands. Smaller brands shipping fewer than 5,000 orders per month generally see 40–50% off published rates, while larger brands shipping 25,000 to 100,000 orders monthly can negotiate discounts of 60–70%.

For example, in 2024, supplement brand Semaine Health used ShipBob's Inventory Placement Program (IPP) to distribute inventory across four U.S. fulfillment centers. This reduced their transit times from 5.2 days to 3.6 days and lowered their fulfillment costs by $2.16 per order compared to their previous 3PL.

These benchmarks provide a foundation for optimizing shipping zones and carrier strategies.

Zone Optimization and Carrier Selection

Shipping zones are a major driver of fulfillment costs. Shipping locally within Zone 2 can be 2.3 times cheaper than shipping coast-to-coast to Zone 8. By spreading inventory across multiple fulfillment centers, 3PLs help brands lower the average shipping zone for each order.

3PLs also optimize carrier selection by blending national carriers (like UPS and FedEx), regional carriers (such as OnTrac and LaserShip), and postal services (USPS). Regional carriers often offer rates that are 20% to 35% lower than national carriers for orders in Zones 5–8. A typical 3PL carrier mix might look like this: 60% UPS, 20% FedEx, and 20% USPS or regional carriers, ensuring both cost efficiency and redundancy.

Another effective strategy is "intelligent ground" shipping. For Zones 2–5, ground shipping can meet 2–3 day delivery expectations at much lower costs compared to air services. Air freight is significantly more expensive: 2-Day Air costs 2.8 times more, and Next-Day Air is 5.6 times more expensive than ground shipping. By reserving air freight for long-distance zones and relying on ground shipping for closer deliveries, brands can cut blended costs by 33% while still meeting delivery speed expectations.

Brands using inventory placement programs to ship from multiple locations have saved an average of 6.25% per order on shipping costs. Combining this with carrier diversification and service level optimization allows brands to reduce shipping costs by 25% to 40% without sacrificing delivery speed.

While zone optimization is an effective way to manage costs, another approach involves rethinking the entire fulfillment model.

In-House Fulfillment vs. 3PL Outsourcing

Running fulfillment in-house requires significant upfront investment, while outsourcing to a 3PL turns fulfillment into a flexible expense that adapts to order volume. In-house fulfillment demands costs like warehouse leases, racking systems, equipment, and Warehouse Management Systems (WMS). These fixed expenses remain high even during slow periods, making it hard to scale efficiently.

In contrast, 3PLs offer a variable cost model. Brands only pay for the space and labor they use, with staffing automatically scaling up during busy seasons and down during slower times. Currently, 53% of brands outsource their fulfillment to 3PLs to better manage costs and complexity.

Neil Sant, Chief Operations Officer at J&J Global Fulfillment, highlights this challenge:

"We consistently see brands paying for warehouse capacity they only need during peak seasons. This excess space represents one of the largest hidden costs in fulfillment, tying up capital that could otherwise be invested in product development."

| Category | In-House Fulfillment | 3PL Outsourcing |

|---|---|---|

| Capital Investment | High costs for leases, equipment, and software | Minimal setup; use existing infrastructure |

| Expense Model | Fixed costs, even during slow periods | Pay only for what you use; scales with volume |

| Shipping Rates | Limited negotiating power | Access to deep carrier discounts (15–30% savings) |

| Scalability | Slow and costly to expand | Adapts easily to order volume |

| Technology | Managed by the brand | Included with automation and reporting features |

In-house fulfillment may be a good fit for brands with steady order volumes or specialized needs. However, managing a warehouse comes with challenges, including a 49% annual turnover rate in the industry, which can hurt accuracy and raise costs. Leading 3PLs, on the other hand, maintain pick-and-pack accuracy rates of 99.5%+, offering reliability that’s hard to match without significant investment.

For most DTC brands, outsourcing to a 3PL becomes cost-effective once order volumes reach 1,000–1,500 orders per month. Beyond that, the savings from reduced shipping zones and optimized carrier rates typically outweigh the additional management fees. This flexible model is crucial for brands scaling their operations across the country.

sbb-itb-eb0f906

Technology Features That Support 3PL Success

A strong technology stack is what sets leading 3PLs apart. By 2025, a striking 94% of 3PL respondents rank Artificial Intelligence as the most influential technology in the industry. Additionally, 74% of shippers say they’d consider switching providers based solely on their AI capabilities. For DTC brands expanding into regional markets, the technology offered by a 3PL directly impacts how quickly they can launch, how accurately orders are fulfilled, and whether the logistics partner meets agreed contract terms. These tech-driven capabilities are becoming non-negotiable as DTC brands scale.

Required Technology Features for DTC Fulfillment

Modern 3PLs must deliver on several key tech fronts to support DTC growth. These include native integrations with platforms like Shopify, WooCommerce, Amazon, and TikTok Shop; real-time inventory visibility; SLA monitoring tools with live dashboards; advanced analytics; and warehouse automation features like scan-to-pick and routing orders to the nearest hub.

Real-time inventory visibility is critical, particularly when managing stock across multiple fulfillment centers. This ensures accurate inventory tracking and minimizes errors. SLA monitoring tools are equally important, helping hold 3PLs accountable by tracking metrics like order accuracy (99.5%+), on-time shipping (at least 95% same-day), and receiving windows (24–48 hours). The best 3PLs offer live KPI dashboards with automated alerts for any performance dips below agreed thresholds.

Advanced analytics tools provide a "control tower" view, offering insights into carrier performance, exception management, and root cause analysis for delays. Warehouse automation, including scan-to-pick verification and automated routing, helps maintain accuracy and prevents costly shipping errors. Currently, 86% of 3PLs offer real-time visibility as a standard, while 94% provide Electronic Data Interchange (EDI) and 84% include Transportation Management Systems (TMS). For DTC brands, selecting a 3PL capable of onboarding platforms within two to four weeks is essential to avoid delays in scaling.

| Essential Tech Feature | Purpose for DTC Brands | Must-Have Benchmark |

|---|---|---|

| Native API Integration | Real-time sync with Shopify/Amazon | <4-week onboarding |

| Inventory Visibility | Track stock across regional hubs | 99%+ accuracy |

| Automated Tracking | Reduce customer service inquiries | Real-time updates |

| SLA Dashboards | Monitor 3PL performance/accountability | Live data access |

| AI/Predictive Analytics | Demand forecasting and optimization | 94% impact rating |

These features, combined with seamless integration into ecommerce platforms, make them indispensable for DTC success.

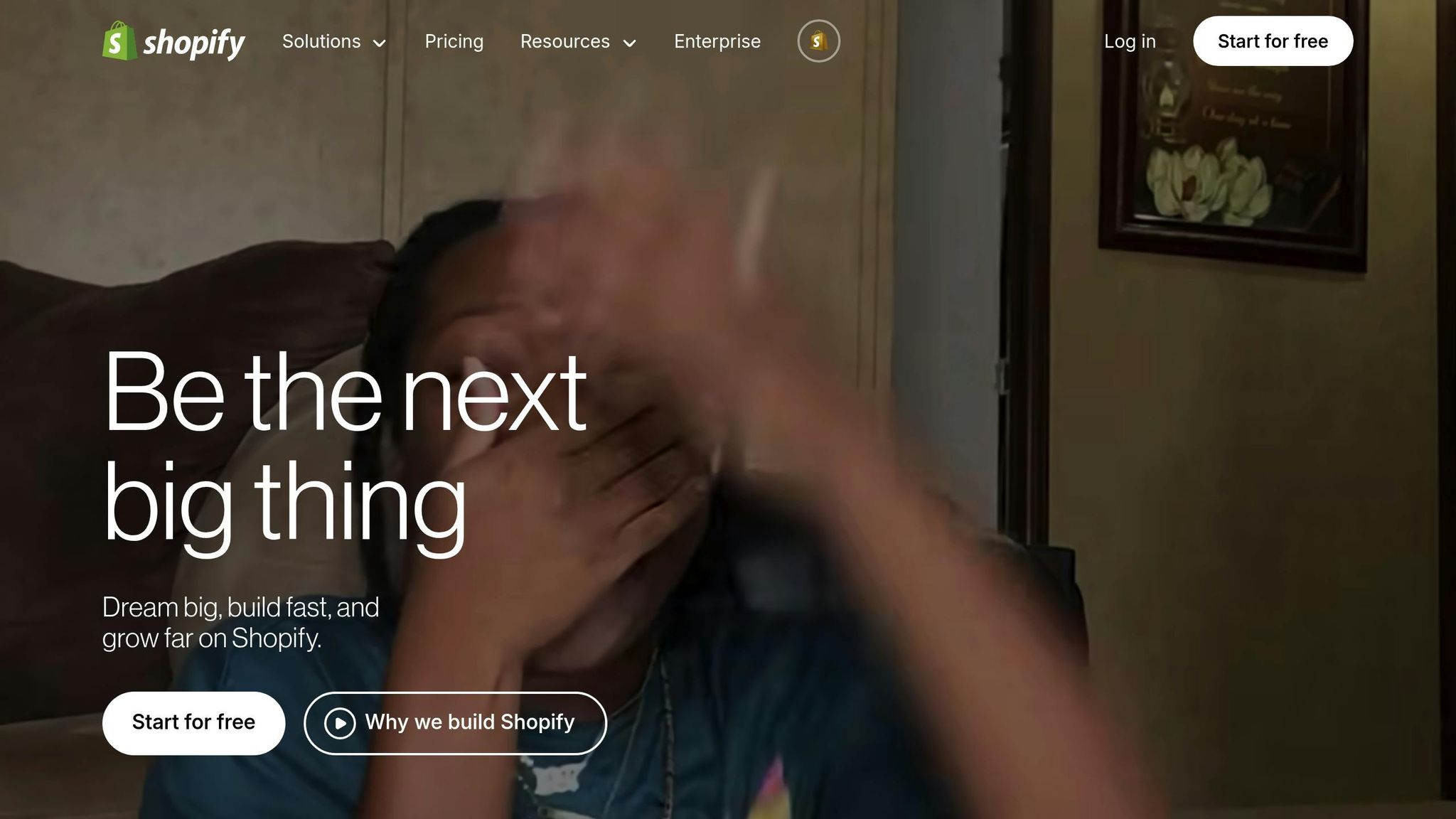

Why Shopify Integration Matters

Shopify integration with 3PL platforms provides a centralized source of truth for orders, customer data, and inventory across the entire fulfillment process. This real-time synchronization ensures accurate tracking and smooth operations. By 2025, 78% of ecommerce brands will sell on two or more channels, making platform integration a baseline necessity rather than a luxury.

Shopify’s integrations simplify omnichannel growth by syncing data from platforms like TikTok Shop, Amazon, and Walmart into one admin dashboard. This allows brands to manage distributed inventory across regional hubs without losing track of stock levels. For example, computer hardware brand NZXT cut fulfillment times from 10 days to under two by integrating ecommerce data with fulfillment processes in late 2025. Similarly, home essentials brand Parachute processed 1,300 click-and-collect orders - 35% of their annual BOPIS volume - during Q4 2024 by leveraging Shopify’s "buy online, pick up in-store" feature, transforming retail locations into mini-fulfillment centers.

"Being able to leverage Shopify's buy online, pick up in-store feature actually allows us to tell our online customers that we even have stores. This allows us to drive traffic to the stores where we know that customers have a really great experience."

– Meg Marsh, SVP of Operations, Parachute

Shopify integration also supports automated order routing, ensuring cost-effective and speedy delivery by directing orders to the closest fulfillment center. Additionally, it aids in exception handling by automating queues for issues like failed authorizations or incorrect addresses, complete with "fix-by" timers. Merchants using advanced inventory placement programs achieve near-perfect fulfillment accuracy - up to 99.95% - by leveraging these integrated systems.

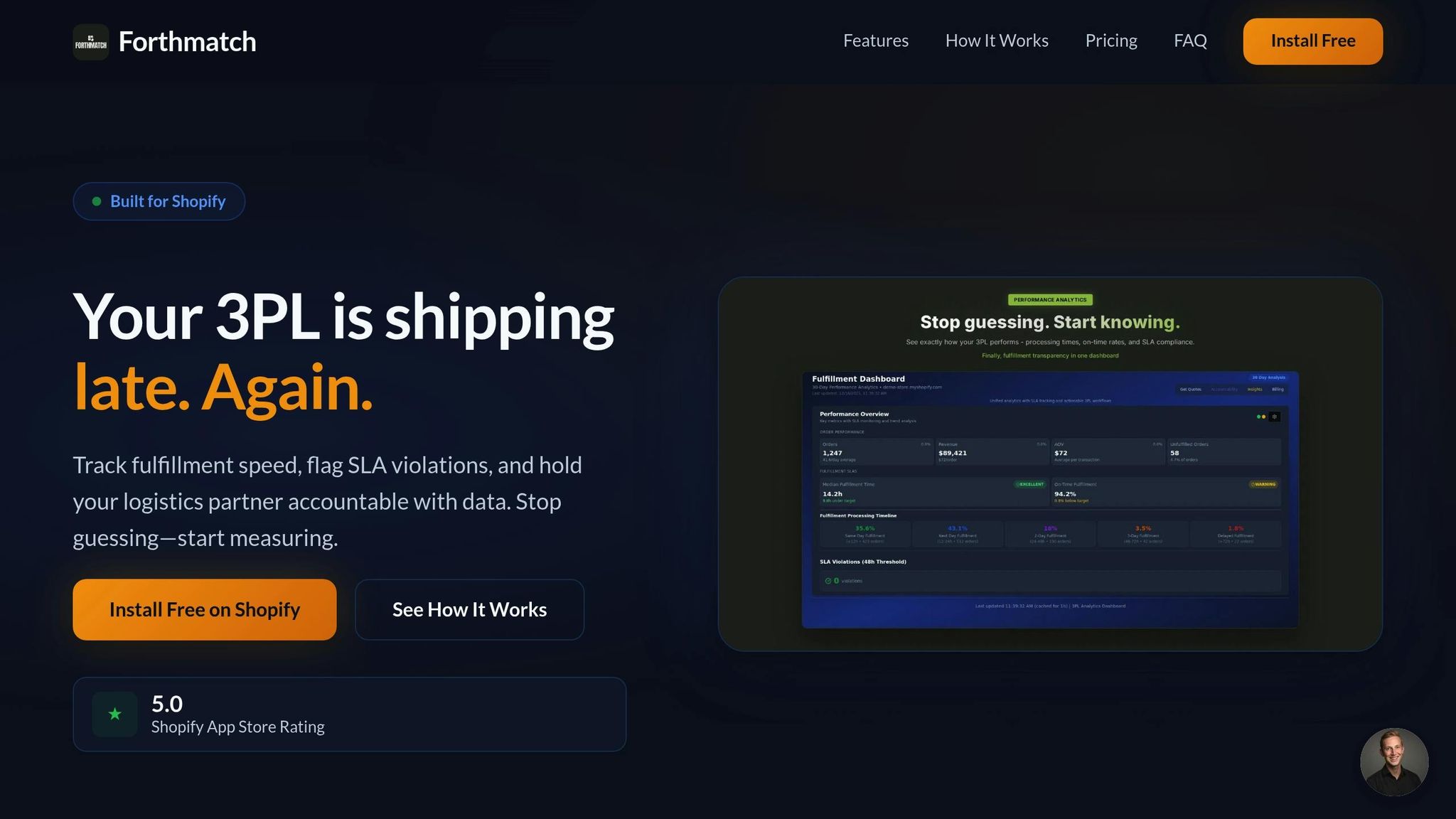

Using Forthmatch to Track 3PL Performance

Even with advanced 3PL systems, brands need independent tools to verify performance and ensure accountability. Platforms like Forthmatch bridge this gap, enabling DTC brands to track logistics performance and optimize regional operations. Forthmatch integrates directly with Shopify to monitor shipping times, flag SLA breaches, and generate evidence-based reports for contract negotiations. Upon installation, it analyzes up to 90 days of order history, tracking the time between "Order Created" and "Fulfillment" timestamps.

Brands can set custom SLA targets - for example, "ship within 24 hours" - and Forthmatch sends alerts whenever these targets are missed. It identifies root causes for delays, such as carrier issues, weekend bottlenecks, or receiving problems, and provides detailed carrier performance comparisons for FedEx, UPS, and other regional providers. This turns vague concerns into actionable insights, like pinpointing that 15% of orders missed a 24-hour SLA.

The platform’s Accountability Session feature, priced at $89 per session, establishes a performance baseline over a two-to-four-week monitoring period, generating a detailed PDF report ideal for quarterly reviews or renegotiations. If performance doesn’t improve, the RFP Quote Request tool ($44 per request) generates a data-driven Request for Proposal, matching brands with vetted regional providers. Forthmatch’s subscription option, Performance Insights, costs $19 per month (with a 14-day free trial) and provides extended analytics, trend reporting, and priority support.

What to Consider When Entering Regional Markets

Expanding into regional markets isn’t just about cutting costs - it’s about navigating the maze of regulations and operational realities. For direct-to-consumer (DTC) brands, teaming up with third-party logistics (3PL) providers can simplify the process, but only if critical factors like state licensing and workforce stability are handled with care. Overlooking these details can lead to delays or compliance headaches, which can quickly wipe out any cost savings.

Regulatory and Compliance Requirements

When entering a regional market, the first hurdle is meeting state and federal compliance standards. For instance, under 21 USC 360eee-3, 3PL facilities managing regulated products like pharmaceuticals or supplements must either hold state licenses or gain approval from the Secretary of Health and Human Services if no state program exists. If your products cross state lines, the destination state may also require licensing for the 3PL provider.

Beyond licensing, 3PLs must maintain written policies covering areas like inventory control, loss reporting, and security. They’re also responsible for conducting background checks on facility managers, ensuring that individuals with felony convictions related to product tampering or drug violations are excluded from these roles. If you’re targeting cross-border markets, compliance with USMCA/CUSMA is essential. This includes accurate commercial invoices, proper tariff codes, customs fees (ranging from $15–$30 per package, plus 5–15% duties), and bilingual packaging for Quebec.

To avoid last-minute crises, brands should audit top 3PL providers 6–12 months before they anticipate hitting capacity limits. This gives time to confirm compliance measures and ensure the 3PL can handle specific needs, like storing hazardous materials in line with local safety regulations.

Location Selection and Workforce Availability

Choosing the right location is a balancing act between customer proximity and labor market stability. In the U.S., four states - California, Texas, Florida, and New York - account for 37% of ecommerce orders and 36% of Gross Merchandise Volume (GMV). These regions promise quick delivery times but come with higher labor costs and elevated warehouse turnover rates. The warehouse industry’s annual turnover rate sits at around 49%, and wages in transport and logistics have risen sharply since the COVID-19 pandemic - four times faster than pre-pandemic levels.

"The labor shortage was exacerbated by the COVID-19 pandemic, with the result that post-COVID-19 wages in transport and logistics are four times higher than before the pandemic."

– McKinsey & Company

For a more cost-effective option, North Carolina offers a strategic middle ground. It allows access to 70% of the U.S. population within a single day via ground shipping. When vetting 3PLs, ask for turnover data from the past year and current pick-and-pack accuracy rates. Providers unable to supply this information may not have the stability or efficiency you need. Multi-client fulfillment models, where labor is shared across clients, can also help manage demand spikes during peak seasons.

Once you’ve ensured compliance and workforce stability, the next step is to evaluate the physical infrastructure and logistics setup.

Real Estate and Infrastructure Considerations

Real estate and infrastructure are the backbone of any regional expansion strategy. The costs and quality of these elements directly affect your fulfillment expenses. For example, coastal markets like Los Angeles and Orange County offer quick port access but come with steep rents and low vacancy rates. Inland areas, such as California’s Inland Empire, provide lower costs while maintaining solid connectivity through major interstate corridors like I-10, I-15, and I-40.

"The geographical location of 3PL partner warehouses... is not just a logistical detail; it's a strategic imperative."

– Dave Jesse, COO, Bonded Logistics

Modern logistics demand facilities that can handle high volumes efficiently. This includes "Class A" warehouses with features like high clear heights, advanced racking systems, and ample trailer parking to support automation. Evaluate the 3PL’s dock-to-stock speed - ideally, inventory should be ready within 24–72 hours of arrival. Keep in mind that moving from a single warehouse to multiple locations often requires about 30% more inventory to maintain stock across the network. Brands shipping fewer than 100 orders per day or generating less than $5 million in GMV should stick to one strategically located warehouse to avoid excess inventory.

Finally, calculate the Total Cost of Fulfillment (TCF), which includes hidden fees, error rates, and customer service overhead. For example, a 3PL that charges $0.50 less per pick but operates at 97% accuracy instead of 99.5% could end up costing more due to returns and customer service issues. Don’t forget to assess weather resilience and disaster contingency plans, especially for regions prone to extreme weather. This ensures your operations can continue smoothly, even under challenging conditions.

Conclusion: Using 3PLs to Scale Regionally

Growing a DTC brand regionally isn’t just about finding more storage space - it’s about smart distribution and data-driven accountability. The numbers speak for themselves: brands leveraging multi-node fulfillment networks can reduce shipping times by 71% and save an average of 6.25% per order on shipping costs. Considering that shipping expenses typically account for 8–12% of total revenue for most DTC brands, these savings can make a huge difference.

The real advantage comes from combining a reliable 3PL partner with advanced tracking tools. Success stories from top brands show that placing inventory strategically and monitoring performance closely can slash delivery times and cut fulfillment costs and hidden fees significantly. These results are rooted in objective data and a commitment to consistent performance evaluation.

Choosing the right technology is just as critical as picking the right 3PL. Tools that offer real-time SLA monitoring and root cause analysis are game-changers. For example, Forthmatch integrates seamlessly with Shopify to flag late shipments, evaluate carrier performance, and generate detailed reports that can strengthen contract negotiations. Affordable solutions like these turn logistical challenges into actionable insights. And if your current 3PL isn’t meeting your standards, the RFP Quote Request tool lets you compare alternatives using real order data - no guesswork involved.

Scaling regionally in a sustainable way requires fulfillment that’s not only optimized but also measurable. Brands that succeed don’t just delegate logistics; they hold their partners accountable with hard data. As Sergio Tache, CEO of Dossier, aptly stated:

"Scaling is great, but it also comes with certain headaches... you need a partner that can handle your volume, even as it's skyrocketing to over a million orders".

The same principle applies to your tech stack - it should grow with you, not slow you down. At its core, sustainable regional expansion relies on measurable results and technology-driven insights. These strategies ensure every part of your operation supports your growth goals.

FAQs

How do 3PLs help direct-to-consumer (DTC) brands save on shipping costs and improve delivery times?

Third-party logistics (3PL) providers offer a smart way for DTC brands to cut shipping costs by strategically storing inventory in regional warehouses. This tactic, known as zone skipping, reduces the distance packages travel by consolidating shipments to regional hubs before the last leg of delivery. The result? Brands can save 20–30% on last-mile delivery costs, with per-order expenses dropping to about $3–$7 instead of the $5–$10+ it often costs with in-house fulfillment. Plus, 3PLs take advantage of bulk shipping discounts through pre-negotiated carrier contracts, driving costs down even further.

Faster delivery is another major perk. By keeping inventory closer to customers, 3PLs make it easier to offer quicker standard shipping options, like two-day or even same-day delivery, without relying on pricey express services. This streamlined process not only reduces transit delays but also ensures more consistent delivery times, giving customers a better overall experience. Tools like Forthmatch add an extra layer of efficiency by providing brands with real-time insights into fulfillment performance, automating provider selection, and refining logistics strategies to balance cost savings with speed.

What should DTC brands look for when choosing a regional distribution corridor?

When choosing a regional distribution corridor, DTC brands need to consider factors that directly influence delivery speed, costs, and supply chain reliability. Start by looking at the proximity to your key customer base. Keeping inventory closer to your shoppers can cut down on shipping times and lower transportation costs. Also, evaluate the transportation infrastructure in the area. Easy access to major ports, highways, and rail networks can streamline both inbound and outbound logistics, while densely populated local markets can help reduce last-mile delivery expenses.

Don’t overlook the total costs involved. This includes storage fees, pick-and-pack charges, carrier discounts, and any extra services your logistics partners might offer. Make sure these costs fit within your budget and match your order volume. Additionally, consider risk and resilience. Regionalizing your supply chain can help shield your operations from disruptions, whether they’re economic or related to natural events. However, it’s essential to assess risks specific to each market.

To simplify this process, tools like Forthmatch can be incredibly helpful. They provide real-time analytics, automated quotes from 3PL providers, and SLA benchmarks, allowing you to make well-informed decisions that balance speed, cost, and dependability as your business grows.

How does technology improve 3PL partnerships for DTC brands?

Technology has reshaped the way 3PL (third-party logistics) partnerships work, turning them into a key advantage for DTC (direct-to-consumer) brands. With modern tools, brands gain real-time visibility into inventory, order statuses, and shipping performance. This level of insight helps brands quickly address demand surges, shipping delays, or any unexpected errors. Features like API integrations with e-commerce platforms streamline order processing, while automated tracking keeps customers updated throughout the delivery process.

Cutting-edge tools, such as AI-powered demand forecasting and route optimization, play a big role in cutting shipping costs and ensuring reliable deliveries. Platforms that track and measure service-level agreements (SLAs) also allow brands to hold their 3PL partners accountable and negotiate better deals. For Shopify merchants, solutions like Forthmatch bring all these capabilities together in a user-friendly system. They provide real-time analytics, automate quote requests, and offer data-driven performance reviews - all designed to help DTC brands grow efficiently, without hidden fees or unnecessary middlemen.