Hidden fees in 3PL (third-party logistics) agreements can quietly drain your profits. These charges often hide in contracts, invoices, and rate cards, impacting costs for storage, shipping, and order processing. Here's how to protect your margins:

- Understand Hidden Fees: Common examples include storage penalties, fuel surcharges, and account setup costs.

- Review Contracts Carefully: Scrutinize clauses for price escalations, shrinkage allowances, and renewal terms.

- Request Detailed Quotes: Insist on itemized rate cards and sample invoices to reveal all potential costs.

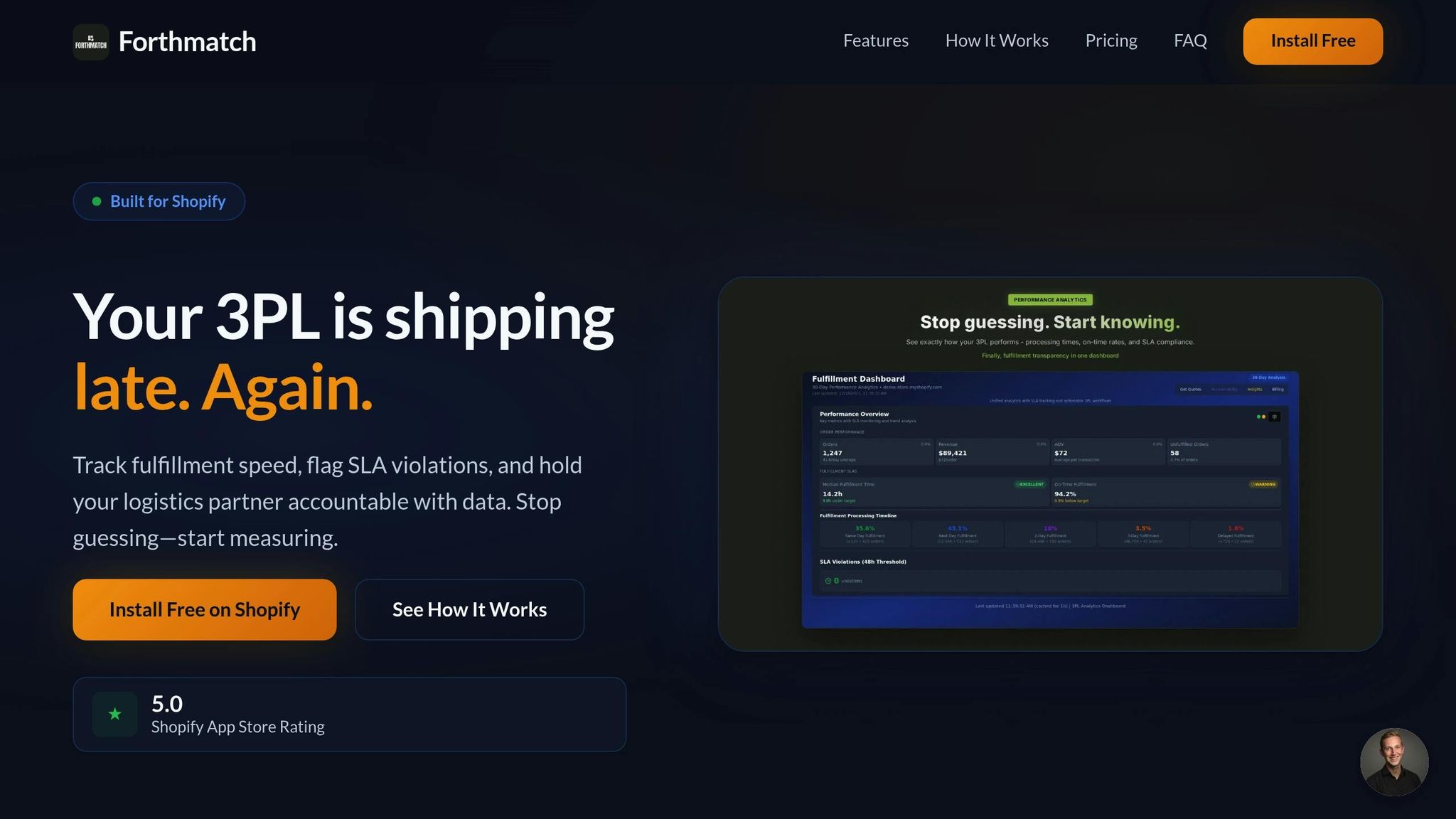

- Monitor Costs Regularly: Use tools like Forthmatch to track invoices, flag errors, and analyze trends in real time.

- Negotiate Terms: Secure clear service standards, audit rights, and flexible termination clauses to avoid surprises.

With thorough planning and active cost management, you can minimize unexpected charges and keep fulfillment expenses predictable.

Carrier Surcharges Explained: Hidden Shipping Fees Every Shipper Must Watch Out For

Common Hidden Fees in 3PL Agreements

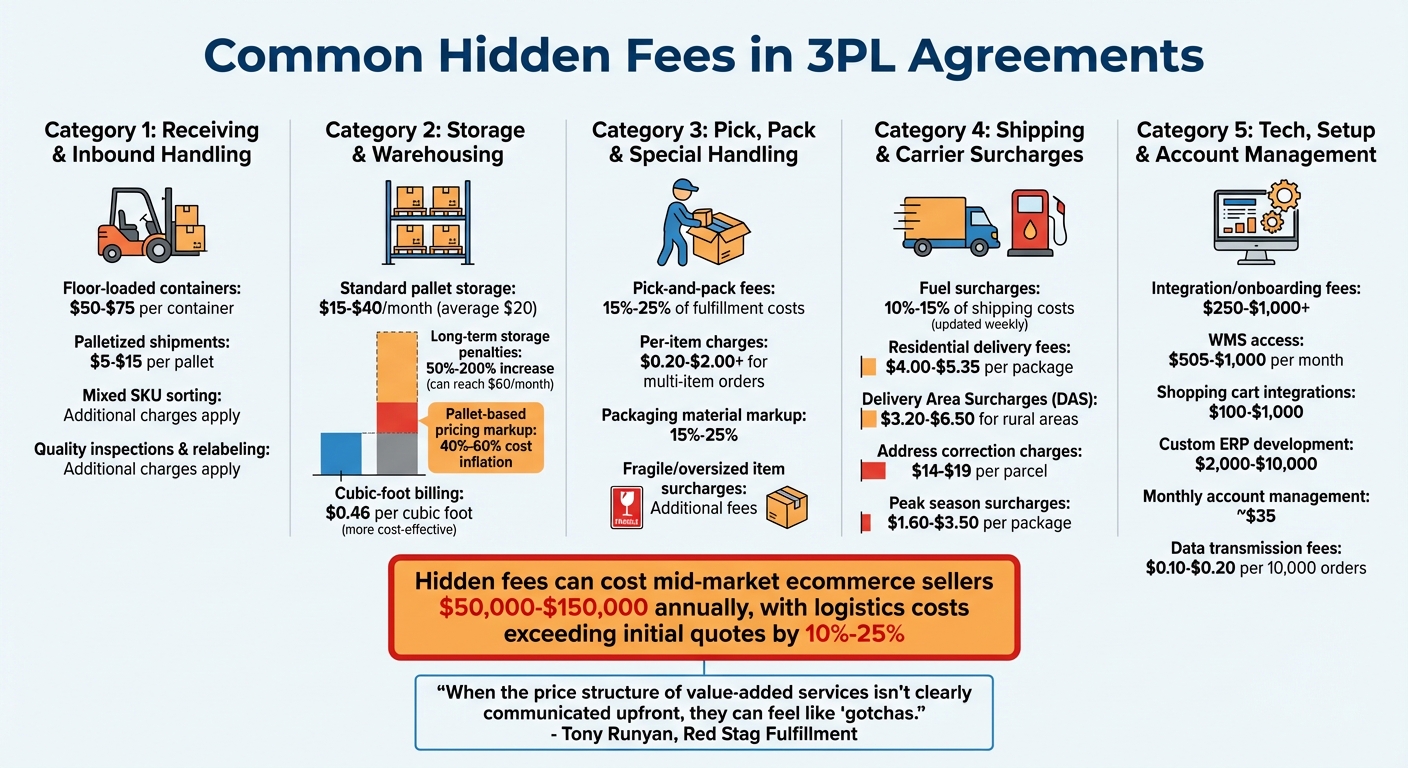

Common Hidden Fees in 3PL Agreements: Cost Breakdown by Category

Receiving and Inbound Handling Fees

How your inventory arrives can significantly affect your costs. For example, floor-loaded containers - where products are stacked loose instead of palletized - can cost anywhere from $50 to $75 per container to unload. On the other hand, palletized shipments are less expensive, with fees ranging from $5 to $15 per pallet.

If your pallets contain mixed SKUs, you might face extra charges for sorting and reorganizing the inventory. Additional fees may also apply for tasks like quality inspections, relabeling, or handling non-standard packaging.

And that’s just the start - storage fees can add even more to your expenses.

Storage and Warehousing Fees

Storing inventory isn’t as straightforward as it seems. The average cost for standard pallet storage is about $20 per month, though rates can range from $15 to $40. If your inventory sits idle for too long - typically over 30, 60, or 90 days - 3PLs often impose long-term storage penalties, which can increase storage rates by 50% to 200%. That $20 monthly fee could balloon to $60 in no time.

Another factor to consider is pallet-based pricing, which can inflate your costs by 40%–60%. Why? You’re charged for the entire pallet footprint, even if it’s only half full. A more cost-effective option might be cubic-foot billing, which charges around $0.46 per cubic foot based on the actual space your products occupy.

Pick, Pack, and Special Handling Fees

The costs don’t stop at receiving and storing inventory. Order processing fees can also take a big chunk out of your margins.

Pick-and-pack fees alone make up 15%–25% of fulfillment costs. While 3PLs often quote a "per order" fee, they also add per-item charges ranging from $0.20 to over $2.00 for multi-item orders. Packaging materials are another area where costs can creep up, with markups of 15%–25%. You might also encounter surcharges for handling fragile or oversized items, providing kitting services, or including custom inserts.

Shipping and Carrier Surcharges

Shipping costs are another area where hidden fees can pile up. Many 3PLs add fuel surcharges, which average 10%–15% of shipping costs and are updated weekly. Residential delivery fees tack on an additional $4.00 to $5.35 per package, while Delivery Area Surcharges (DAS) for rural ZIP codes range from $3.20 to $6.50.

Another common practice is Dimensional Weight (DIM) pricing, where you’re charged based on the size of the package rather than its actual weight. Using a divisor (often 166), carriers calculate the billable weight. Other potential fees include address correction charges of $14 to $19 per parcel when shipping details are incomplete and peak season surcharges of $1.60 to $3.50 per package, which can extend well beyond the holiday season.

Tech, Setup, and Account Management Fees

Tech and account setup costs can also sneak up on you. Integration and onboarding fees typically range from $250 to over $1,000. Access to a Warehouse Management System (WMS) with advanced tracking features can cost $505 to $1,000 per month. Shopping cart integrations might add $100 to $1,000, while custom ERP development can run between $2,000 and $10,000.

Recurring fees are another concern. Monthly account management charges, usually about $35, cover basic services like document storage and reporting. As your business grows, you might also face data transmission fees - $0.10 to $0.20 per 10,000 orders - and system maintenance surcharges. These ongoing costs can make switching providers financially challenging, especially if service quality declines.

As Tony Runyan, Chief Client Officer at Red Stag Fulfillment, points out:

"When the price structure of value-added services isn't clearly communicated upfront, they can feel like 'gotchas.'"

How to Identify and Prevent Hidden Fees During Negotiations

Where Hidden Fees Appear in Proposals, Contracts, and Invoices

Hidden fees often lurk in Master Service Agreements (MSAs), rate cards, and invoices. Since MSAs are typically vendor-friendly templates, it’s crucial to scrutinize clauses that impose minimum charge penalties, even when discounts have been negotiated. Pay special attention to shrinkage allowances, as they can mask substantial annual losses.

Be cautious of price escalators tied to the Consumer Price Index (CPI) or clauses that allow arbitrary percentage increases. Watch out for evergreen clauses that automatically renew contracts for one to three years unless you provide notice 60 to 90 days in advance. Additionally, be wary of a Warehouseman’s Lien clause, which could allow the third-party logistics provider (3PL) to hold your inventory until all invoices are settled.

Monthly invoices are where hidden fees translate into actual costs. Keep an eye out for line items like account management fees (often around $35 per month) and Warehouse Management System (WMS) access charges, which can range from $500 to $1,000 monthly. Earlier sections of this guide detail common surcharges to be aware of.

By identifying these areas, you’ll be better equipped to ask the right questions and ensure thorough documentation.

Questions to Ask and Documents to Request

Make sure every promise is documented in the contract. Request a sample or pro forma invoice based on your historical order data. This will help uncover hidden line items and give you a clearer picture of your true cost per order.

Ask for a detailed rate card that outlines all services, including storage (whether charged per pallet, bin, or cubic foot), pick-and-pack, receiving, and technology fees. Request carrier rate tables and confirm whether surcharges include markups.

Confirm the DIM divisor (used to calculate dimensional weight) and negotiate it if possible. For high-value inventory, inquire about the shrinkage allowance, which typically ranges from 0.5% to 2%, though some budget providers might set it as high as 4%. Additionally, request a Statement of Work (SOW) that defines all deliverables and secure access to operational reporting tools, such as a report book or portal.

These documents are key to achieving full visibility into fees and ensuring accurate cost forecasting.

How to Structure Agreements for Fee Transparency

To avoid unexpected charges, structure your contract with clear terms from the start. Clearly define service standards and task classifications to eliminate ambiguity and prevent surcharges.

Include audit rights in your agreement, allowing you to review and dispute invoices when necessary. For high-value goods, consider negotiating a zero-shrinkage Service Level Agreement (SLA), holding the 3PL accountable for any lost inventory - even if this results in a slightly higher base fee. You can also include a chargeback clause to hold the 3PL financially responsible for errors such as delayed shipments.

Establish a clear timeline for transitioning to "steady-state" operations, complete with stricter KPIs, to prevent extended periods of higher onboarding rates. Negotiate payment terms of 30 to 90 days to maintain working capital, or request a 0.5% to 1% discount for early payments made within 10 days. Lastly, include a termination for convenience clause that allows you to exit the contract with 60 to 90 days’ notice - an essential safeguard if service quality declines.

sbb-itb-eb0f906

Using Data and Monitoring to Avoid Fee Creep

Regular Invoice Audits and Cost Reconciliation

Did you know that up to 66% of shipping invoices contain errors? That’s why it’s critical to audit each monthly invoice against your contracted rates. This helps you catch discrepancies, such as incorrect base rates, misclassified freight zones, or duplicate and unapproved charges, before they spiral into bigger problems.

To ensure accuracy, ask your 3PL to provide copies of original carrier invoices. This way, you can confirm that pass-through costs - like freight and shipping - are billed at actual cost rather than inflated rates. It’s worth noting that over 80% of 3PL warehouses lose revenue due to uncaptured charges, which might push them to adjust fees aggressively. Your audits become the primary safeguard against unexpected cost increases.

"Auditing your invoices isn't just about catching errors - it's about capturing value." - Shipstore

These audits don’t just uncover errors; they also lay the groundwork for monitoring broader operational trends that could influence your costs.

Tracking Cost Drivers and Operational Trends

Beyond audits, it's essential to keep an eye on the factors driving your costs. Track SKU growth, order profiles, and inventory turnover to anticipate pricing thresholds and avoid unnecessary surcharges. For instance, businesses with high SKU counts that store products on partially-filled pallets could save around 40% by switching to cubic-foot pricing.

Another key area to monitor is inventory aging. Long-term storage penalties can range from 1.5 to 3 times the standard pallet rate. If your inventory lingers longer than planned, your costs could skyrocket without warning. Additionally, changes in your order mix - such as an increase in heavier items or residential deliveries - can lead to higher fuel surcharges (typically 10% to 15% of the label cost) and residential delivery fees (ranging from $4.00 to $5.35 per shipment).

Using Forthmatch for Real-Time Monitoring

To take your cost control to the next level, integrate these practices with advanced monitoring tools like Forthmatch. This platform connects directly to your Shopify store, providing real-time analytics and SLA tracking to instantly flag fee creep. Its SLA Analytics Hub offers detailed reporting, identifying overcharges, categorizing issues, and benchmarking your 3PL’s performance against historical data. This gives you the leverage to hold your providers accountable.

Forthmatch also enables data-driven performance reviews, helping you address discrepancies quickly. With no middlemen or referral fees, you get transparent insights without any conflicts of interest. By keeping a close watch on cost drivers and operational trends in real time, you can catch unauthorized markups, validate contracted rates, and maintain full visibility into your total fulfillment expenses.

Conclusion: Protecting Margins with Fee Visibility and Active Management

Hidden fees in 3PL agreements can quietly chip away at your profit margins. For mid-market ecommerce sellers, these unquoted surcharges and extra fees can add up to a staggering $50,000 to $150,000 annually. On top of that, logistics costs often exceed initial quotes by 10% to 25%. To safeguard your margins, you need a proactive approach: thorough contract reviews, clear fee structures, and ongoing monitoring powered by data.

Start by calculating the total, all-in fulfillment cost rather than comparing individual line items. Tony Runyan, Chief Client Officer at Red Stag Fulfillment, stresses that true apples-to-apples comparisons between 3PLs require looking at the complete picture. Request detailed, itemized quotes that cover everything - storage, processing, transportation surcharges, and returns. Then, negotiate contract terms to include key protections like audit rights, clear SLA penalties, and tighter shrinkage allowances (aim for 0.5% instead of the typical 2%). Once your contracts are locked in, the real challenge is maintaining control over costs.

To prevent fee creep, monitor expenses in real time with regular invoice audits and tracking. Set a target logistics rate - ideally less than 15% of sales - and use automated alerts to flag any overages. Tools like Forthmatch can make this process seamless, connecting directly to your Shopify store to deliver real-time analytics, SLA tracking, and performance benchmarking - all without involving middlemen or referral fees. By staying vigilant, you can ensure your logistics costs remain predictable and manageable.

FAQs

What hidden fees should I watch out for in 3PL contracts?

Hidden fees in 3PL agreements can pile up fast if you’re not vigilant during negotiations. Some of the most common charges to watch for include unexpected storage fees (like those for long-term storage or oversized items), handling surcharges tied to pick-and-pack services, and minimum billing requirements or volume commitments. You might also encounter fuel surcharges, dimensional weight adjustments, seasonal rate changes, and even account setup or management fees.

To steer clear of these surprises, take the time to carefully review contracts, request a detailed breakdown of all potential fees, and establish clear communication about pricing terms from the start. Tools like Forthmatch can also be valuable, helping you track and compare 3PL performance to ensure your logistics partnerships remain transparent and reliable.

What steps can I take to avoid hidden fees in my 3PL contract?

To keep surprise expenses out of your 3PL agreement, make sure the contract spells out every fee - from storage and pick-and-pack charges to minimums, seasonal rate changes, and fuel surcharges. Ask for detailed monthly statements to track costs and, if possible, negotiate for caps or discounts tied to volume. Including audit rights in the agreement can also help you double-check charges for accuracy.

Before finalizing the deal, have both a legal expert and a logistics consultant review the terms. They can catch any fine-print details that might lead to hidden fees. These steps can help you maintain clarity and control over your logistics spending.

How can I effectively track and manage 3PL costs to avoid hidden fees?

To keep 3PL expenses under control and steer clear of hidden fees, it's essential to use tools that offer real-time visibility, automated cost tracking, and data-driven performance insights. Look for platforms that sync seamlessly with your e-commerce store - such as Shopify - so you can centralize key data like orders, storage, and shipping. This helps you stay on top of costs like pick-and-pack fees, storage charges, and any unexpected surcharges.

If you're looking for a modern pay-as-you-go option, Forthmatch is worth considering. It provides real-time fulfillment analytics, automated quote requests from top regional providers, and performance reviews based on historical SLA benchmarks. With no middlemen or referral fees, Forthmatch ensures complete transparency, making it easier to manage and optimize your 3PL partnerships.