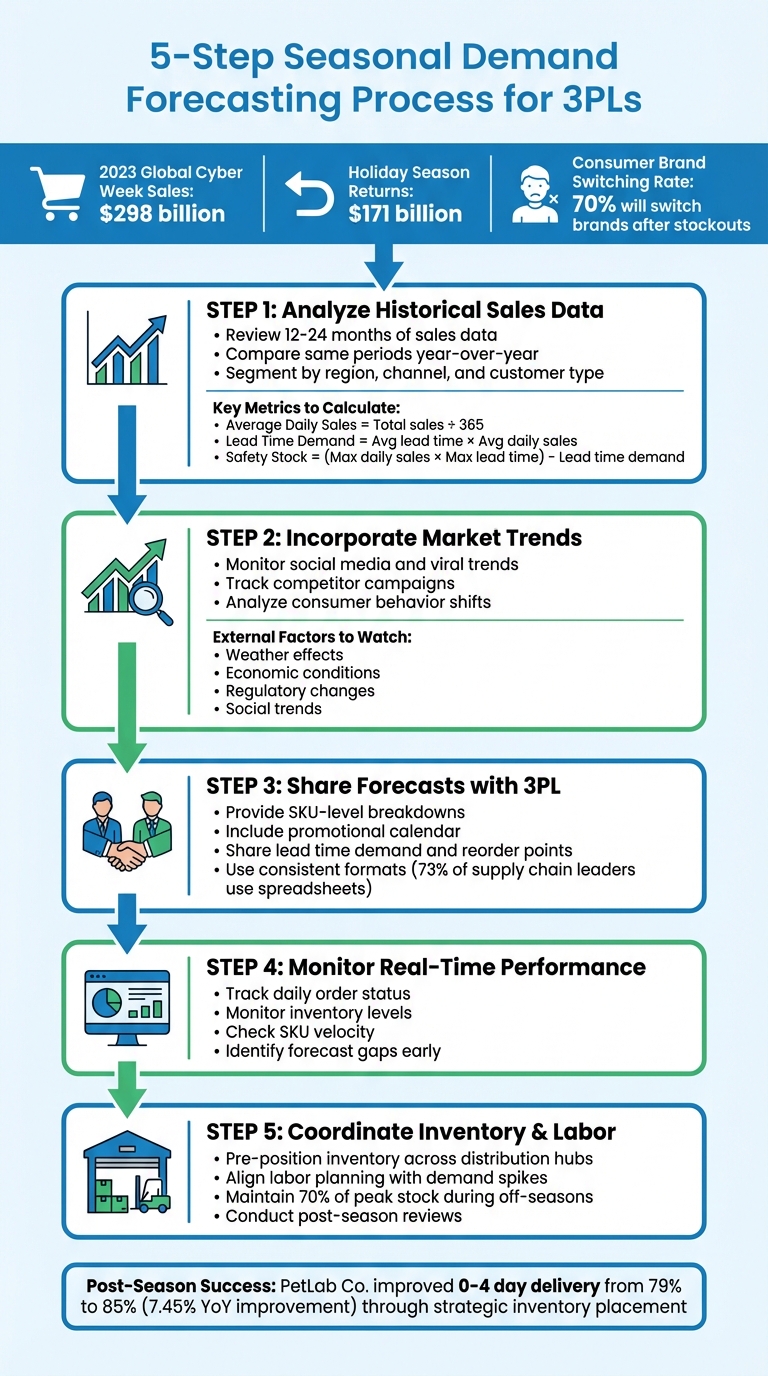

Accurately forecasting seasonal demand is essential for e-commerce brands partnering with 3PLs (third-party logistics). Without precise predictions, brands risk stockouts, high storage costs, and shipping delays, especially during peak shopping periods like the holidays. Here’s a quick breakdown:

- Why It Matters: In 2023, global Cyber Week sales hit $298 billion, but $171 billion worth of goods were returned during the holiday season. Poor forecasting can disrupt inventory, labor, and delivery schedules.

- How to Do It:

- Analyze at least 24 months of sales data to spot trends.

- Track key metrics like average daily sales, lead time demand, and safety stock.

- Factor in external influences like weather, economic shifts, and viral trends.

- Share detailed forecasts with your 3PL, including SKU-level data and promotional schedules.

- Monitor real-time performance and adjust forecasts as needed.

Key Takeaway: By aligning forecasts with your 3PL’s capabilities, you can manage inventory, labor, and shipping more effectively, ensuring smooth operations during demand spikes. Tools like Forthmatch simplify this process with real-time analytics and actionable insights.

5-Step Seasonal Demand Forecasting Process for 3PL Partners

Analyze Historical Sales Data for Seasonal Trends

Review Sales Data from the Past 12–24 Months

To build accurate seasonal forecasts, you’ll need at least two years (24 months) of historical sales data. While shorter timeframes can work for simple predictions, identifying consistent patterns and separating them from random anomalies usually requires a longer window. The goal is to pinpoint recurring spikes or dips in demand rather than reacting to one-off fluctuations.

When analyzing your data, make sure to compare the same time periods across years. For example, if you’re forecasting demand for Q2 2026, use Q2 2024 and Q2 2025 data as a baseline. This method helps isolate seasonal trends from broader market changes. It’s equally important to differentiate predictable seasonality (like holiday shopping surges) from unexpected disruptions, such as the significant 32.4% growth in online retail during the 2020 pandemic.

Segmenting your analysis by region, sales channel, and customer type can uncover nuanced seasonal trends. For example, a swimwear brand might see summer sales peak earlier in Southern California compared to the Pacific Northwest. If your brand offers more than 10 products, grouping them into product lines can make forecasting more manageable while still capturing seasonal trends. As ShipBob explains:

"The best way to understand how your brand's seasonality and product demand during various periods throughout the year is to look at historical data".

A real-world example comes from Caraway, which automated inventory forecasting during a 51% surge in home goods demand. This approach allowed them to maintain accurate delivery timelines and grow sustainably despite supply chain challenges.

Once you’ve identified historical trends, fine-tune your projections by focusing on key performance metrics.

Track Key Metrics for Forecast Refinement

After spotting seasonal patterns, it’s essential to track forecast accuracy by comparing predicted demand with actual sales. This helps identify gaps and improve future forecasting models. Keep an eye on inventory turnover to avoid tying up capital in slow-moving stock, and monitor order fill rates to ensure your 3PL can handle peak-season demand.

Here are three critical calculations to support data-driven forecasting:

- Average Daily Sales = Total sales last year ÷ 365

- Lead Time Demand = Average lead time (in days) × Average Daily Sales

- Safety Stock = (Maximum daily sales × Maximum lead time) – Lead Time Demand

Your reorder point - calculated as lead time demand plus safety stock - acts as a clear trigger for replenishing inventory.

Tracking these metrics at the SKU level, rather than across your entire catalog, ensures you can make precise seasonal adjustments for specific products. Between peak seasons, maintaining minimum inventory at about 70% of your peak-season stock levels can help you stay prepared until your next major restock. Tools like Forthmatch (https://forthmatch.io) simplify this process by providing real-time analytics that track these metrics and help you collaborate seamlessly with your 3PL partners.

Incorporate Market Trends and External Factors

Use Industry and Consumer Behavior Insights

Historical sales data gives you the "what", but understanding market trends and consumer behavior provides the "why" - and even hints at what’s coming next. While quantitative forecasting leans on past numbers, qualitative approaches draw from industry expertise, economic changes, and product life cycles to capture what raw data might miss.

To get a clearer picture, look beyond sales figures and analyze demand drivers. Consider how campaigns, media coverage, or major events can impact demand. For example, a strong advertising push might significantly boost orders, but without proper inventory planning, you could end up creating demand that you can’t meet - wasting ad dollars in the process.

Social media trends are another powerful force. Viral moments on platforms like TikTok can cause products to sell out overnight, completely disrupting traditional seasonal patterns.

Don’t forget to monitor your competition. New players entering the market or a competitor’s promotional campaign can quickly shift demand away from your brand. An adaptable forecasting model is essential to stay ahead of these shifts.

By combining these insights, you’ll be better equipped to anticipate and prepare for market fluctuations.

Prepare for Unexpected Variables

Even with thorough market analysis, unpredictable external factors can throw a wrench into your forecasts. That’s why robust planning includes buffer inventory to handle sudden disruptions. Weather changes, economic downturns, regulatory shifts, and political instability can all create unexpected demand swings that historical data alone won’t predict. For instance, an unusually warm winter could sink sales of seasonal coats, while an extended rainy season might drive up demand for indoor-focused products.

Here’s a quick breakdown of external factors and how to handle them:

| External Factor | Impact on Demand | Recommended Action |

|---|---|---|

| Weather Effects | Seasonal sales may drop (e.g., warm winters vs. coats) | Monitor long-range forecasts to adjust stock levels |

| Economic Conditions | Shoppers may opt for budget-friendly alternatives | Adjust pricing strategies and inventory mix |

| Regulatory Changes | Could limit product availability or market access | Diversify suppliers to avoid single-point failures |

| Social Trends | Viral moments can cause unpredictable demand spikes | Use social media analysis to react to short-term trends |

Diversifying your supply chain is another way to build resilience. Work with both domestic and international suppliers to minimize risks from regional disruptions or regulatory changes. Keep in mind how holidays like Chinese New Year can extend lead times and plan accordingly.

Leandrew Robinson, General Manager of Mesh Logistics at Auctane, emphasizes the importance of precision:

"If supply chain forecasting isn't accurate down to a couple of weeks, it can cause costly ripple effects that will zap the profitability of an entire quarter or half-year."

Another variable to account for is returns, which can significantly disrupt your forecasts. Between Thanksgiving and January, product returns can exceed $171 billion in value, making post-season forecasting tricky. Incorporating return rates into your demand models can help you avoid overstocking or understocking as the season winds down.

Communicate Forecasts to 3PL Partners

Share Forecasts in Clear and Consistent Formats

Once you've developed your demand forecast, it's crucial to present it in a format that's both detailed and easy for your 3PL to use. Interestingly, 73% of supply chain leaders still rely on spreadsheets for planning and forecasting activities. Spreadsheets act as a universal language for most 3PLs, making them an effective tool to communicate your data. When your 3PL has access to clear, structured information, they can better align their operational strategies with your forecast.

Consistency and detail are key. Go beyond total order volumes and provide a breakdown at the SKU level. This helps your 3PL prepare for specific items that may experience demand surges. If your product catalog includes more than 10 items, consider grouping them into product lines - this keeps the data manageable while retaining important insights.

Include essential metrics like SKU velocity and lead time demand in your forecast. Don’t forget to highlight promotional dates. Your 3PL needs to know when marketing efforts or product launches are planned so they can scale up seasonal labor. Will Kerr, Apparel Lead at Quadrant, emphasizes the importance of this preparation:

"The key to this model is ensuring we are able to fulfill a massive spike in demand within a reasonable timeframe. With ShipBob, we are able to trust that orders will get out in a timely manner."

Sharing your promotional calendar early allows your 3PL to prepare for demand spikes using Collaborative Planning, Forecasting, and Replenishment (CPFR).

Align Forecasts with 3PL Lead Times

Detailed forecasts are just the beginning - timing is equally important. Synchronizing your predictions with your 3PL's operational lead times ensures smooth execution. After all, your 3PL can't ramp up labor or secure extra warehouse space overnight. They need advance notice to test systems and lock in carrier capacity, particularly during peak seasons when surcharges begin as early as August.

Provide your 3PL with lead time demand and reorder points, calculated based on your forecasting formulas. This enables them to proactively secure resources and avoid bottlenecks.

Steve Congro, Sr. Director of Systems at Saddle Creek Logistics Services, highlights the importance of collaboration in this process:

"For a third-party logistics provider with a high volume of parcel shipments, preparing for peak season is a year-round activity. It is a collaborative effort between our technology, parcel and operations teams."

Beyond inventory management, aligning forecasts with lead times also impacts carrier planning. Your 3PL needs sufficient notice to secure carrier capacity and handle peak surcharges. Strategic inventory placement further enhances efficiency. For instance, in 2023, PetLab Co. partnered with their 3PL to analyze geographic demand data and distribute inventory across multiple fulfillment centers. This approach allowed 85% of their orders to reach customers within 0–4 days, achieving a 7.45% year-over-year improvement.

The stakes couldn’t be higher - 70% of consumers will switch brands if they encounter a stockout while shopping online.

Modern tools like Forthmatch simplify these processes by integrating directly with platforms like Shopify. Forthmatch automatically compiles key performance metrics and generates actionable reports, making it easier to share forecasts and reduce stockouts efficiently.

Monitor Real-Time Performance and Adjust Forecasts

Track Forecast Accuracy and Identify Gaps

Once you've built your forecasts using historical trends and key metrics, the next step is to monitor how those forecasts hold up in real time. Creating a forecast is just the beginning - you need to track performance against actual results. Compare your predictions to real sales data regularly, whether weekly or even daily during peak periods, to spot any deviations early on. Many 3PLs provide proprietary dashboards that offer insights like daily order status, inventory levels, and days of stock remaining. These tools can help you keep an eye on SKU velocity, showing whether items are selling faster or slower than you expected.

Pay particular attention to outliers. Viral social media posts or underperforming campaigns can skew your numbers significantly. If a promotion falls short, adjust your inventory orders immediately. Similarly, monitor return rates closely to avoid ending up with excess stock.

These real-time insights naturally set the stage for post-season reviews, which are essential for refining your future forecasts.

Run Post-Season Reviews for Continuous Improvement

Once the peak season wraps up, it's time to sit down with your 3PL partner for a thorough post-season review. Steve Congro, Senior Director of Systems at Saddle Creek Logistics Services, puts it best:

"Peak season is never over until we've reviewed 'lessons learned.' Inevitably, there are things that can be improved on."

Use variance analysis to examine the gaps between your forecasts and actual sales. This review is your opportunity to fine-tune the models you initially built using historical data and market insights. Whether it involves tweaking ARIMA parameters, recalculating safety stock levels, or revisiting lead time assumptions, the goal is to understand where and why your predictions fell short. Take note of both successes and challenges, such as unexpected SKU performance or carrier delays.

For example, between 2022 and 2023, PetLab Co. Co-CEO Stephanie Lee worked with their 3PL to analyze real-time demand data and improve inventory placement. By leveraging insights from their post-season reviews, they boosted the percentage of orders delivered within 0–4 days from 79% to 85%, marking a 7.45% improvement year-over-year.

Platforms like Forthmatch make this process even easier by automatically tracking your 3PL's fulfillment performance during the season. They flag SLA violations, categorize delays by cause, and generate detailed reports. These reports not only help you hold your logistics partner accountable but also provide leverage to negotiate better terms for the next peak season.

sbb-itb-eb0f906

3PL Survival Guide [Riding the Waves of Client Sales]

Coordinate Inventory and Labor with Your 3PL

Once you’ve established accurate forecasts and open communication with your 3PL, the next step is to coordinate inventory and labor to handle seasonal demand effectively.

Pre-Position Inventory Across Distribution Hubs

Forecasts are more than just numbers - they’re a roadmap for positioning inventory where it’s needed most. By analyzing regional demand patterns, like increased winter gear sales in the Northeast, you can allocate stock strategically to warehouses closer to your customers. This not only speeds up delivery but also cuts shipping costs by reducing the distance between your products and their final destinations.

To take it a step further, integrate your ERP system with your 3PL’s WMS. This connection ensures real-time stock visibility and optimal inventory placement. It also helps prevent overselling and ensures each distribution hub is stocked appropriately for its region.

Another way to fine-tune inventory management is through an ABC analysis. By categorizing items into "A" (high-value/high-volume), "B", and "C" groups, you can prioritize your best-sellers for prime positioning in warehouses closest to demand. This method minimizes the risk of stockouts while avoiding the costs of overstocking.

Once your inventory is set up, the next focus is on aligning labor resources with these projections.

Align Labor Planning with Seasonal Demand

Your forecasts don’t just guide inventory - they’re also critical for workforce planning. Sharing seasonal projections with your 3PL well in advance allows them to adjust their staffing levels to handle peak demand. This proactive approach ensures On-Time In-Full (OTIF) fulfillment during busy periods and eliminates the chaos of last-minute hiring.

"With an accurate demand forecast, brands and their 3PLs can plan more efficiently, from fulfilling orders, right down to the delivery." – Jarrett Stewart, SVP, Commercial, GoBolt

If you’re planning campaigns or flash sales, make sure your 3PL is in the loop. For example, during the 2023 holiday season, global online Black Friday sales jumped 8% year-over-year. Handling such spikes requires careful labor coordination. By relying on your 3PL’s experienced workforce for the entire fulfillment process, you can sidestep the risks and costs of managing seasonal hires on your own.

To keep everything running smoothly, consider using tools like Forthmatch (https://forthmatch.io) for real-time performance analytics. These tools help you and your 3PL stay aligned, ensuring both inventory placement and labor planning are perfectly tuned to meet seasonal demands.

Conclusion

Seasonal forecasting lays the groundwork for smoother collaboration with your 3PL partner by relying on data and trends to guide your operations. Start by analyzing historical data and current market conditions to create a solid forecast.

Share your forecasts early, keep them updated as circumstances shift, and communicate any planned promotions or expected volume surges. When you and your 3PL are aligned, you can strategically position inventory, coordinate labor effectively, and sidestep the chaos of last-minute adjustments during peak seasons.

Treat forecasting as an ongoing effort. Regularly monitor how accurate your forecasts are and evaluate performance after each season. This continuous feedback helps fine-tune your approach, turning every seasonal cycle into a chance to improve coordination and efficiency moving forward.

FAQs

How does historical sales data help improve seasonal demand forecasting for 3PLs?

Historical sales data is a game-changer when it comes to refining seasonal demand forecasting for 3PLs. By diving into past sales trends, identifying peak seasons, and examining year-over-year patterns, businesses can make more precise predictions about future demand. This level of insight allows for smoother coordination with 3PL partners, particularly in areas like inventory management and logistics planning.

Accurate forecasting helps e-commerce brands sidestep issues like stockouts or overstocking, ensuring fulfillment operations run smoothly during busy seasons. When these insights are shared with 3PL providers, it boosts overall efficiency, cuts unnecessary costs, and improves the customer experience.

What metrics should e-commerce brands track to forecast seasonal demand accurately?

Accurate seasonal demand forecasting hinges on tracking a few essential metrics. One of the most important is forecast accuracy, which measures how well predicted demand aligns with actual sales. This insight helps fine-tune future projections. Another critical metric is inventory accuracy, ensuring that your recorded stock levels match what’s physically available - an absolute must for dependable planning.

Metrics like order fulfillment cycle time and order fill rate also play a key role. These assess how quickly and effectively orders are processed and delivered. Keeping an eye on these figures enables e-commerce brands to work more seamlessly with 3PL partners, streamline inventory management, and guarantee on-time deliveries during high-demand periods. By prioritizing these KPIs, businesses can better prepare for demand shifts and keep operations running smoothly all year round.

How do factors like weather and social trends affect seasonal demand forecasting?

External influences like weather and social trends heavily influence how consumers behave, directly affecting seasonal demand. For instance, chilly temperatures typically boost the need for winter clothing, while a trending social event or a viral product can spark a sudden surge in interest.

By studying historical data, businesses can spot these patterns and use them to refine demand forecasts. This allows for smoother collaboration with 3PL partners, helping to minimize the chances of running out of stock or holding excess inventory during busy periods.